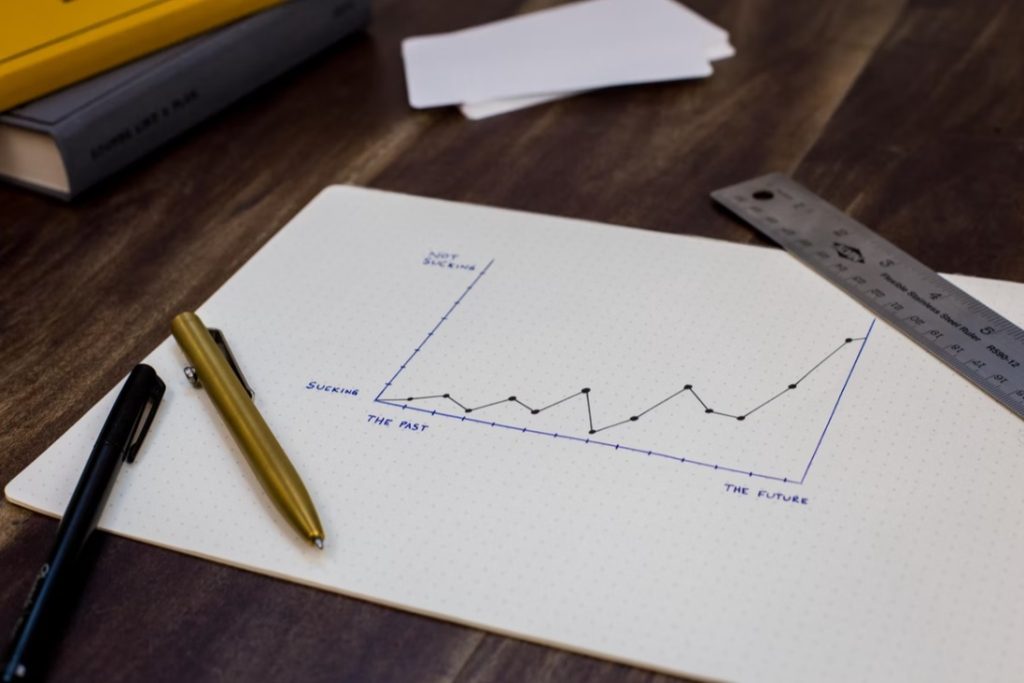

There are various methods to get profit from trading cryptocurrency. Strategy trading aid you in managing those techniques into a rational structure you can follow. That way, you can consistently check and optimize your crypto strategy.

We can illustrate a strategy trading as an extensive map for all your trading activities, and it’s a structure you develop to guide you in all trading tasks.

Also, a trading plan can aid you in alleviating financial risk because it reduces plenty of pointless decisions. While having a strategy for trading is not compulsory for trading, it can be beneficial sometimes.

If something unpredicted happens out there, your trading plan should characterize how you respond – and not your emotions. You can also say that suitable trading can prepare you for the expected results.

It stops you from making impulsive, hasty decisions that often cause huge financial losses.

How to Use Strategy Trading Landing Page: Step-by-Step

Strategy Trading Landing Page on Binance aggregates VP, TWAP, Grid Trading, plus other automated algorithmic trading features.

The latest landing page gives you a detailed presentation of Futures and Spot Grid trading strategies with their popularity and performance among users while enabling traders to imitate their parameters rapidly.

How to access the Strategy Trading Landing Page?

- To access the Strategy Trading Landing Page, you must visit the Binance platform and click on Trade, then Strategy Trading.

- You can also access this landing page through Binance Futures’ trading interface. For this, you need to click on Strategy Trading and then overview.

Features that Strategy Trading Landing Page Offer

Binance is an excellent platform that offers fast access to various automated trading strategies through the Strategy Trading Landing Page, that consist of VP, TWAP, Futures Grid, and Spot Grid algorithmic trading bots.

Long Term Yield Strategy

1. Spot Grid

It is a trading bot that automates selling and buying on spot trading. It is made for placing orders in the marketplace at fixed intervals in a configured budget.

Spot Grid Trading performs on Binance is perfect in volatile marketplaces when rates vary in a particular range.

2. Futures Grid

It enables users to implement Grid Trading tactics to Binance Futures’ Futures Contracts and lets them boost their position sizes with leverage and exploit their potential profit.

Smart Algorithmic Trading

1. TWAP Algo

The TWAP trading algorithm allows users to separate a vast order into smaller amounts and implement them automatically at frequent intervals to reduce price impact.

2. VP Algo

VP trading algorithm performs huge orders with a particular urgency level. It focuses on executing at a speed that complements a section of the real-time marketplace volume by valuing the focused volume participation level.

How to Use Volume Participation (VP) Algorithm on Binance Futures

The VP trading algorithm is a Strategy Trading that allows the implementation of bigger orders with a particular urgency level. Volume Participation is very useful if you want to restrict the order market impact whilst aiming at the average market trading cost over the execution period.

When to use a VP algorithm?

This algorithm is apt for an order execution tactic focusing on executing sizable notional orders bigger than the accessible marketplace liquidity while reducing the market impact.

How to Use TWAP Algorithm on Binance Futures

Binance Futures introduce TWAP (Time-Weighted Average Price) trading algorithm for API users. TWAP trading algorithm enables users to programmatically leverage the in-house algorithmic Strategy Trading capability of Binance to separate a big order into smaller amounts and perform them at frequent intervals to reduce price impact.

What Is a TWAP Algorithm?

Time-Weighted Average Price is an effective algorithmic trade execution tactic that focuses on getting an average execution cost of nearly the time-weighted average cost of the user-specified time.

When to Use a TWAP Algorithm?

This algorithm focuses on optimizing the average price of a trade by carving orders execution over a particular time.

Usually, traders set up the TWAP tactic to perform huge orders while justifying their considerable market impact. Users use TWAP to give a better execution cost in the following cases –

- The expectation of a high-cost volatility period without a downward or clear-up trend.

- Order size bigger than accessible liquidity on the order-book

What Is Futures Grid Trading

It is a trading bot that automates the Strategy Trading of futures contracts. It is made for placing orders in the marketplace at fixed intervals in a configured price range.

The strategy is used when orders are placed below and above the fixed price, making a grid of orders incrementally decreasing and increasing costs.

In this manner, it creates a trading grid.

For instance, a trader could place a purchase order at every $1,000 beneath the market cost of Bitcoin while also placing selling orders at every $1,000 over the market cost of Bitcoin. That takes benefit of range situations.

This algorithm works best in sideways and volatile marketplaces when rates vary in a specified range. This method tries to make revenues on small price fluctuations.

The more grid you embrace, the greater the trade frequency will be. But, it comes with a cost as the revenue you make from every single order is lower.

Hence, it is a tradeoff between making small revenues from several trades versus a tactic with lower frequency while creating more considerable revenue per order.

Grid Trading is live on USD-M Futures, and you can set and tailor grid parameters to decide the lower and upper limits of the grid plus the grid numbers.

After creating the grid, the system will automatically sell or purchase orders at fixed prices.

What is Spot Grid Trading?

Spot Grid Trading performs on Binance and works best in volatile marketplaces when costs vary in a particular range. Basically, grid trading tries to generate revenues on small price variations. Via quantitative trading also assists you in trading wisely and avoiding FOMO.

Conclusion

Planning a crypto Strategy Trading matching your personality style and financial goals is challenging.

To figure out what is working and what’s not, you must track and follow each trading strategy – without breaking the set rules.

Also, it’s helpful to create a trading sheet or journal to monitor each strategy’s performance.

However, remember that you don’t need to pursue the same tactics forever. With enough trading records and data, you should be capable of adapting and adjusting your methods.

Your trading strategies must be continuously changing when you get some trading experience. Distributing various parts of your portfolio to multiple tactics is also helpful. That will help you track each tactic’s performance while practicing the correct risk management.