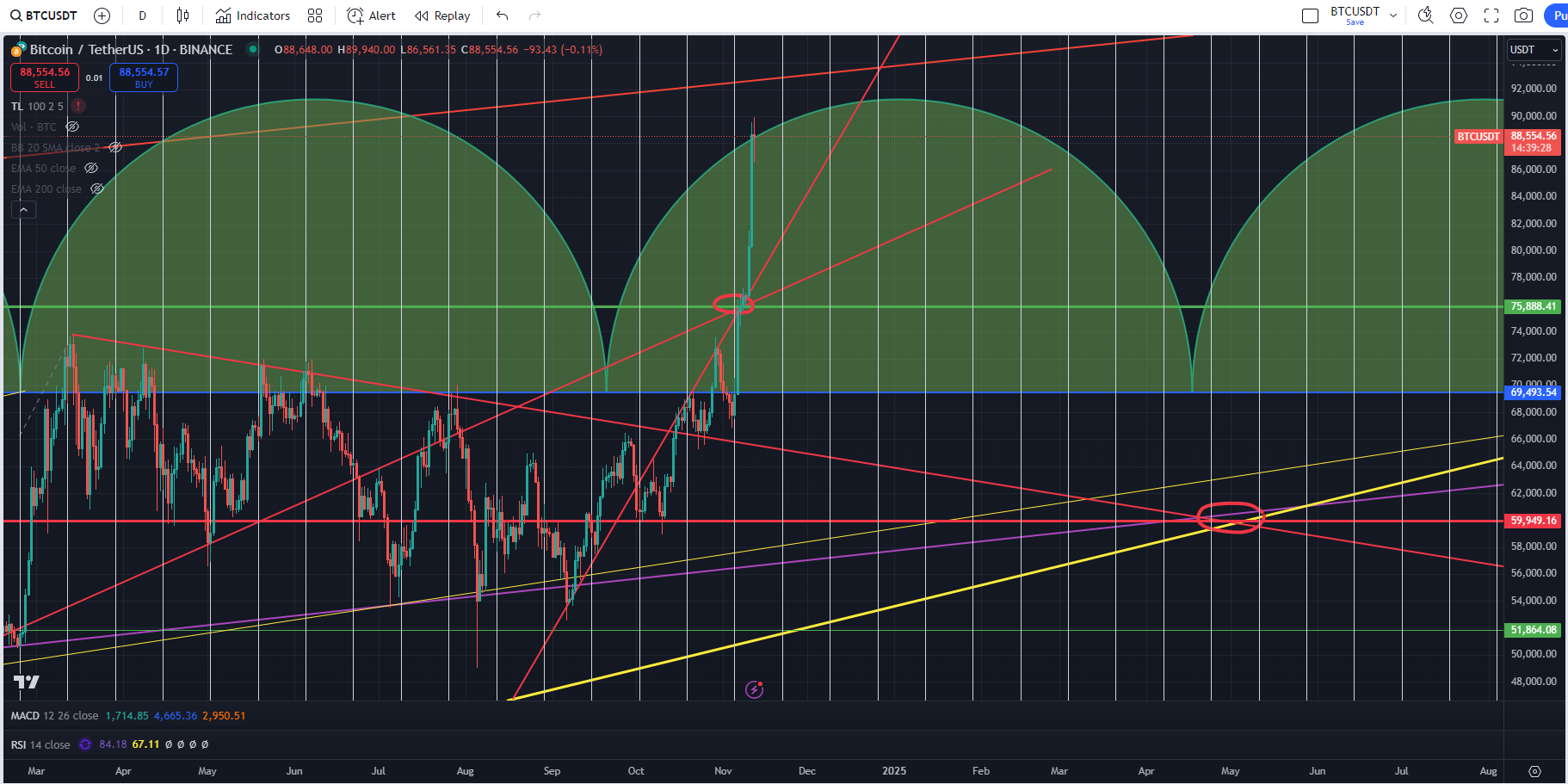

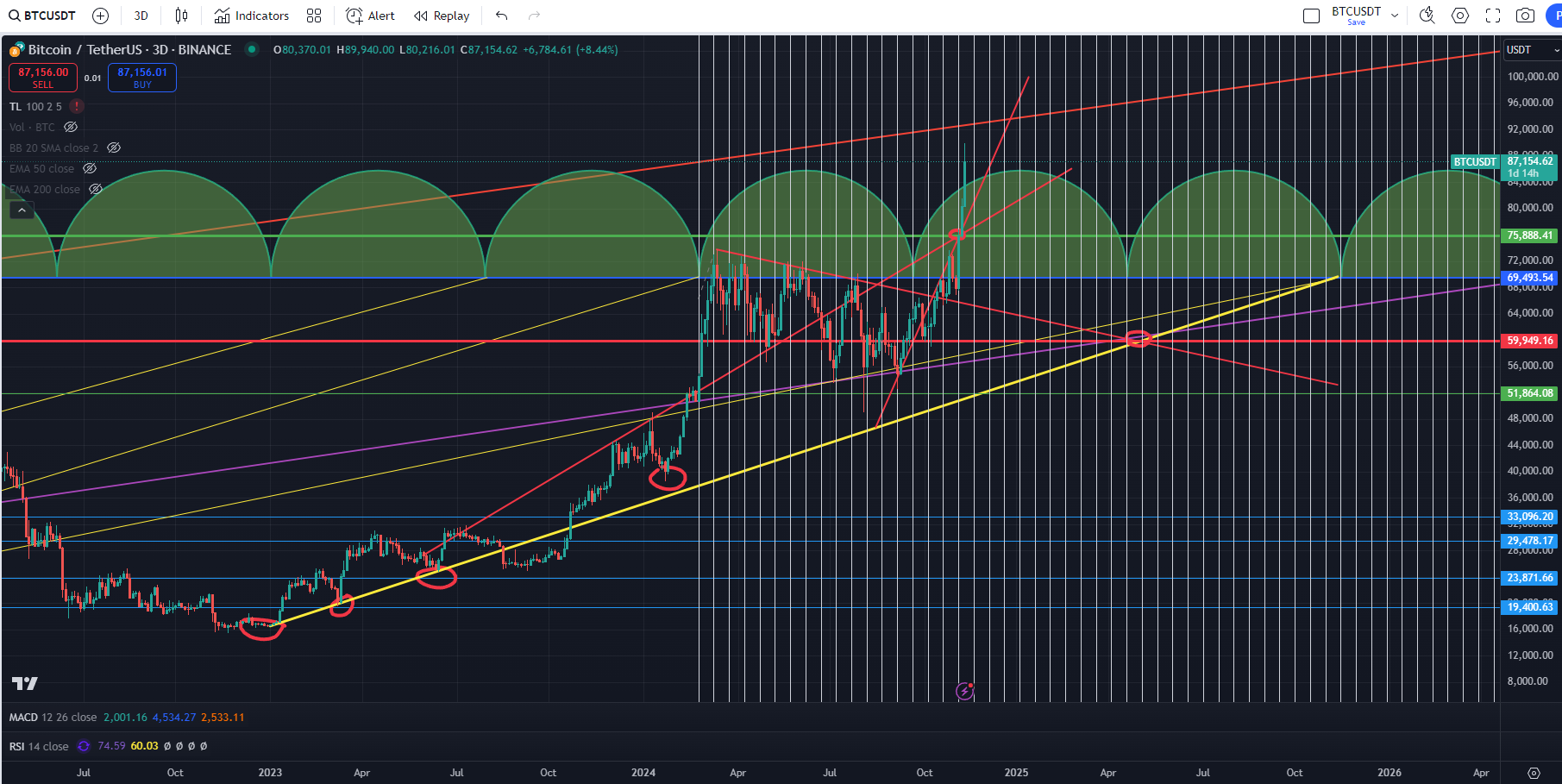

Analyzing recent Bitcoin price action and trend lines reveals a strong bullish trajectory nearing the $90,000 mark. However, long-term projections suggest the possibility of a pullback by May 2025, with the potential to revisit the $59,000 support level.

The chart indicates that Bitcoin is currently in a powerful upward momentum, breaking key resistance zones. The recent upward movement has been driven by macroeconomic factors and market sentiment, pushing BTC towards the significant psychological level of $90,000. Technical indicators such as RSI (currently elevated) and MACD suggest that Bitcoin may still have some upward room but could be approaching overbought territory. This might signal a possible consolidation phase in the near term.

The green arcs on the chart depict cyclical periods that suggest potential peaks and troughs. The green and red trend lines intersect around May 2025, suggesting a price correction towards the $59,000 mark as a potential support level. This intersection, along with the pattern of the cyclical arcs, indicates a possible shift in momentum. This level at $59,000 serves as a critical support zone, aligning with historical price corrections during similar cyclical shifts. Additionally, the intersection of the yellow, red, and green trend lines suggests a confluence zone where price is likely to stabilize before the next upward phase.

If Bitcoin continues on its current bullish path, it might test new highs in the short term. However, a gradual decline towards the $59,000 level by May 2025 aligns with cyclical behavior observed in previous Bitcoin price cycles. This level could act as a foundation for future bullish momentum if macroeconomic conditions remain favorable.